storefront

sell now

storefront

sell now

storefront

sell now

storefront

sell now

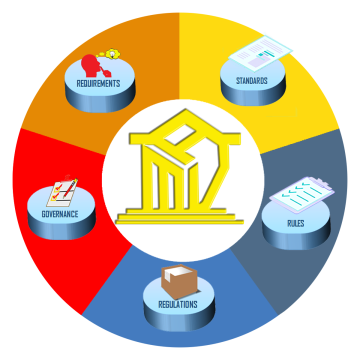

BUSINESS REGISTRATION, RENEWAL & AMENDMENT

Securities and Exchange Commission (SEC) and Department of Trade and Industry (DTI) Registration

Bureau of Internal Revenue (BIR) including eSales, eAccreg, eTIN, eFPS & eBIR enrollment

Mayors / Business Permits & Licenses

Social Security System (SSS)

Philippine Health Insurance (PhilHealth)

Home Development Mutual Fund (HDMF)

Employee registration in DOLE

IP Registration with the Intellectual Property Office of the Philippines of the following:

- Trademark

- Copyright

- Application for Assignment of Registration of Trademark

Registration with the National Privacy Commission of the Philippines

Online Sellers Registration with all government concerned.

Processing Application for Accreditation of Service and Repair Enterprises (SREs) with DTI

Application for accreditation with the Department of Tourism

Application for accreditation as a training facility with the Agriculture Training Institute under the Department of Agriculture

Application for accreditation with the Bureau of Agriculture and Fisheries for Organic and Non-Organic Fertilizers

Importation Registration with Bureau of Customs

Assists in submitting the following DOLE reports for Establishments:

Flexible Work Arrangement/Alternative Work Scheme.

Temporary Closure;

Retrenchment/Reduction of Workforce; and

Permanent Closure.

BUSINESS RETIREMENT / CHANGE OF OWNERSHIP

Point of Sale (POS) Permit Cancellation

Local Government Unit (LGU) Retirement

Deed of Assignment of stocks

LAND /CONDO TITLING SERVICES /OWNERSHIP TRANSFER SERVICES

(Acquired thru: Extrajudicial / Donation / Sale)

eCAR

Extrajudicial Settlement

Publication for Extrajudicial Settlement

Real Property Tax /Tax Declaration (Update /Transfer /Assessment /Payment)

Cancellation of Mortgage Annotation

Certified True Copies or Verification: (Title /Tax Declaration)

Deed of Donation payment of DST and Donors Tax relative to the transfer of title of the property

Assistance on real property tax assess

OTHER SERVICES

Assists in permit application and documentation for transporting non-infectious biological specimens abroad with the Bureau of Quarantine as coordinated with client accredited courier.

Assists in Application for Permit in Asset Disposal with BIR

Assists in submitting Semi Annual and Annual Inventory List to BIR

Assists in Application for Permit and Declaration of Monthly Spoilage, Waste, Expired, Obsolete Item/ Inventory Disposal with BIR

Providing basic advise and assistance regarding DOLE cases.

Providing assistance for BIR audit, rebuttal of notice of discrepancy without settlement but paying the correct tax still due only.

Books of Accounts, OR, SI, CR, BS, SOA writing and updating.

REGULAR ACCOUNT MAINTENANCE

Monthly, Quarterly, Annually BIR Reporting (Including Alphalisting, VAT Reliefs)

Social Security System (SSS)

Philippine Health Insurance (Philhealth)

Home Development Mutual Fund (HDMF) Remittance & Reporting

eBIR, eFPS, eSubmission & eSales Reporting

Sales and Expenses review and formatting

Monthly or Quarterly Financial Statements preparation

ANNUAL AND OTHER SERVICES

BIR & Other Government Audit Assistance

Submission of ANNEX "B-1" or the Income Payee's Sworn Declaration Of Gross Receipts/Sales. (For Self-Employed and/or Engaged in the Practice of Profession with Several Income Payors)

Submission of Lessor's Mandatory Lessee Information Sheet

Submission of Annual Inventory List

SEC Submission of AFS and GFFS

FS, ITR, GIS, GFFS & Other Annual Requirements

AUDIT ASSISTANCE

In the course of attending to an audit inquiry from any agency or company, we are committed to strictly adhering to established protocols. It is our policy to neither offer nor entertain any form of facilitation or bribery.

Our approach to preparing for such inquiries involves a systematic process. Firstly, we gather and document historical information and agreements to facilitate the preparation of response letters to the auditors. Next, we review all supporting documents to develop a strong position and rebuttal letter.

We then proceed to strategize before submitting any relevant documents to the BIR auditor. It is our policy to plan ahead of attending any meetings with BIR representatives.

We remain committed to following up, liaising, and continually strategizing until payment of the desired tax due is achieved. Once the payment has been made through accredited channels of the BIR, we claim our tax clearance or no tax liability notice from the BIR Regional Office.

More Accounting Services in metro manila (ncr)

More listings in Services

Explore more listings